· news · 3 min read

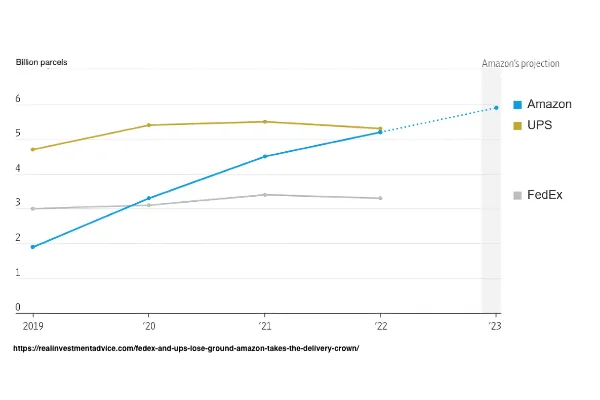

In 2023 Amazon will be bigger than UPS or FedEx

Between 2019 and 2023, Amazon will have tripled the number of parcels it delivers to almost 6 billion from just 2 billion in 2019.

By the end of 2023, Amazon will deliver almost 6 billion parcels. About 2014 when Amazon started delivering some of its own packages, FedEX, UPS and industry analysts laughed at the possibility that Amazon would eclipse them. An actual quote from 2016 by former FedEx CEO Fred Smith:

“Concerns about industry disruption continue to be fueled by fantastical—and I chose this word carefully—articles and reports,” former FedEx CEO Fred Smith said on a conference call with analysts in 2016. “In all likelihood, the primary deliverers of e-commerce shipments for the foreseeable future will be UPS, the U.S. Postal Service and FedEx.”

I bet they are not laughing anymore. In just 4-years, by 2020 Amazon eclipsed FedEx, and it took just another 3-years to eclipse UPS. Another two more years of 31% CAGR growth will make Amazon larger than FedEx and UPS combined. Remember that Amazon still uses UPS to deliver some of its own packages so in-sourcing that will remove substantial volume from UPS and add it to Amazon’s side of the ledger.

Amazon’s foray into delivery started after the disastrous snowstorm of 2013 caused many Amazon packages to arrive late for the crucial Christmas season. The story is lore within Amazon. Frustrated at its dependence on UPS, FedEx and the USPS to make it’s customers happy during the absolutely most important day of the year, Amazon decided it would build its own delivery network and in-source the entire operation. In Amazon’s unique culture, this made perfect sense because Customer Obsession is the very first Amazon Leadership Principle.

Many Wall Street analysts were appalled as this 2016 Reuter’s article demonstrates:

“[Wall Street analysts] …sharply questioned the company’s plans to continue to make heavy investments in logistics, even at the expense of profits. They wondered why it was planning to buy more assets like trucks, and reportedly to lease jets, and worried it planned to spend the money to take on shippers like United Parcel Service Inc.”

In typical Amazon fashion, concerns about share price and Wall Street opinions were ignored. What Amazon has accomplished in less than 10-years with parcel delivery is Amazon’s culture at its absolute best. You have to admire what it can accomplish when it stays hyper focused on Customer Obsession and acting like its still Day 1.

We suspect that Amazon delivery (i.e., ATS) will become it’s next big cash cow alongside AWS. Amazon is planning to double its same-day delivery facilities and - like all that spare compute and storage capacity that became AWS - all that space delivery capacity can be sold to other companies for the 90% of the year that Amazon doesn’t need it for itself. Sound familiar? It should because Amazon is following the same playbook it followed with FBA (sell excess warehouse storage capacity) and AWS (sell excess compute and storage capacity).

symphonie.ai

symphonie.ai