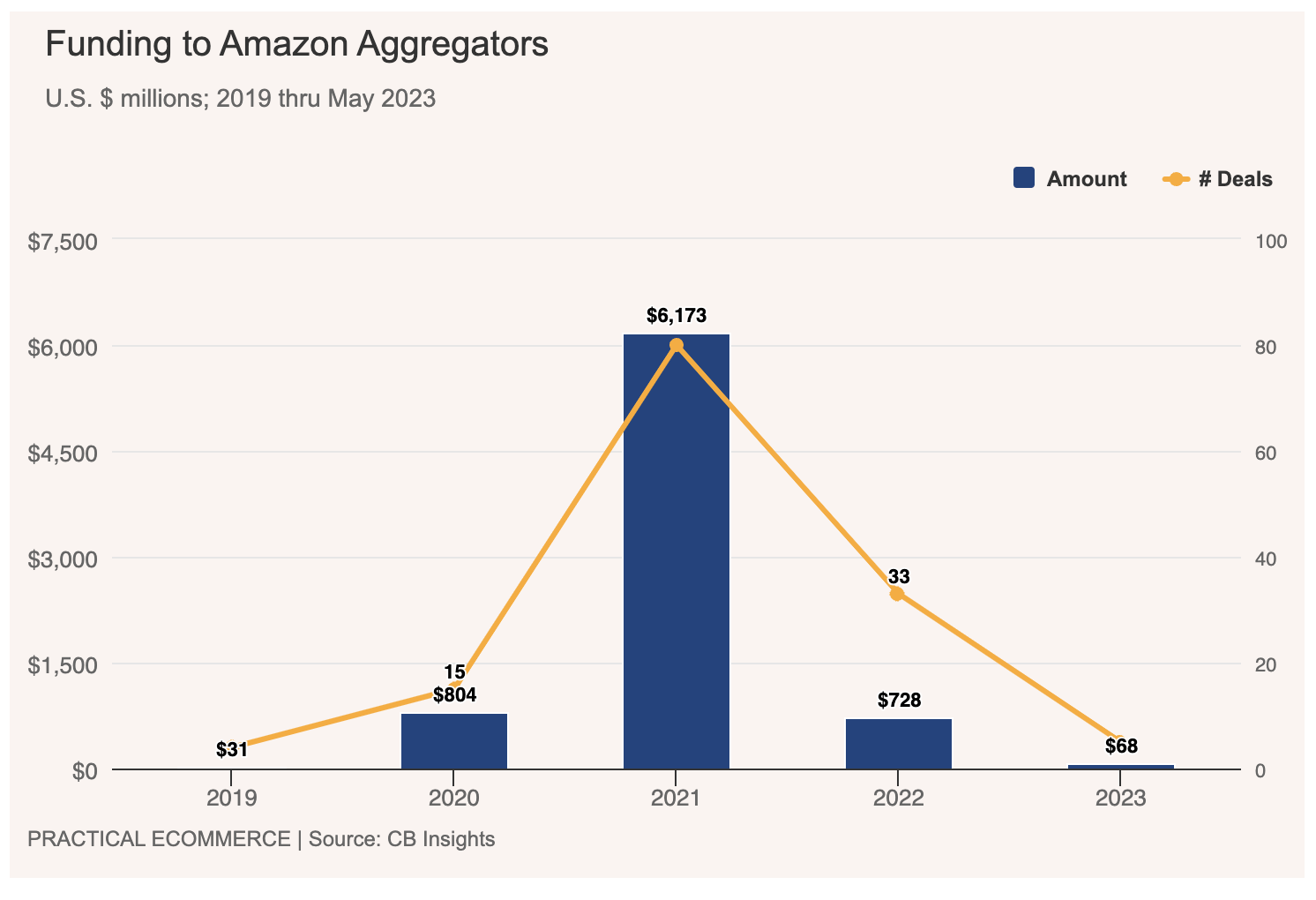

With the bursting of the brand aggregation bubble, it's either learn how to operate a brand or die

Table of contents

Modern Retail recently reported "aggregators are focused on driving organic growth and operational efficiencies to close out a relatively tough 2023." There were some interesting quotes and claims in the article that - based on our own experience operating 20+ brands - merit a grain of salt in accepting them at face value:

- Increasing diversification away from Amazon-only brands will enable more success

- Macroeconomic challenges (post-pandemic shipping costs, rising interest rates) are the real threat to successfully operating an e-commerce brand

- Retailers have the talent to manage increasing complexity and build technology stacks that give them an edge over their rivals

- Training can meaningfully improve brand performance

Diversification is the key

My co-founder and I previously operated 20+ brands that lived on multiple e-commerce marketplaces. Modern Retail glossed over how much complexity increases when you operate on more than one marketplace, which makes it harder to be successful not easier.

The challenge is two-fold: first, there are few good SaaS technology platforms in the marketplace that enable you to make decisions across e-commerce platforms. In fact, the SaaS marketplace for e-commerce technology solutions is highly fragmented both horizontally and vertically. This creates not just operational complexity but also technology complexity. Second, operating on multiple e-commerce platforms exponentially increases the number of decisions you have to make as a brand. If you operate on two e-commerce marketplaces, the decision space increases by a factor of 3x (decisions on marketplace #1, marketplace #2 and decisions across marketplaces because they influence each other). If you are on three e-commerce marketplaces, the it increases by 6x and so on.

Unless you have excellent processes, excellent technology and the right people, you will either struggle to do well on all the e-commerce platforms, or you will naturally focus on just one and ignore the others. In our experience, you inevitably migrate back towards mostly focusing on Amazon because in the US they are still by far the largest e-commerce marketplace.

It was the economy, not us!

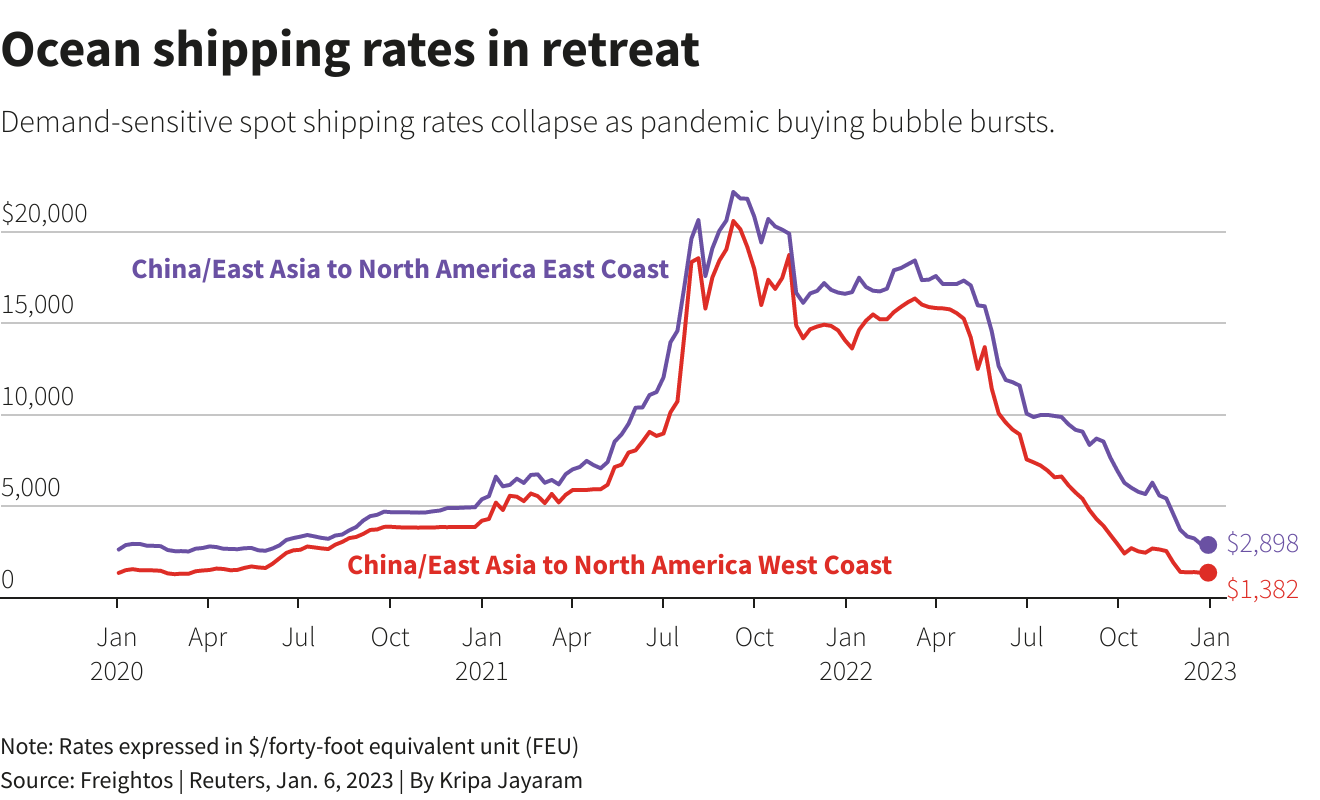

It is easy to blame everything "out there" as at fault for the results of 2022 and 2023 instead of looking inwards. Yes, freight prices did increase in 2022 temporarily such that it was costing upwards of $20,000 to ship a container from China to the US. That did squeeze margins but the phenomena only lasted about a year before prices came tumbling down by April 2023. There are dozens of formerly unicorn (or alive) logistics start-ups dreaming of the $20K per container "good old days" compared to the current $2K cost to ship a container across the ocean. Interest rates are another popular boogeyman.

It is easy to blame everything "out there" as at fault for the results of 2022 and 2023 instead of looking inwards. Yes, freight prices did increase in 2022 temporarily such that it was costing upwards of $20,000 to ship a container from China to the US. That did squeeze margins but the phenomena only lasted about a year before prices came tumbling down by April 2023. There are dozens of formerly unicorn (or alive) logistics start-ups dreaming of the $20K per container "good old days" compared to the current $2K cost to ship a container across the ocean. Interest rates are another popular boogeyman.

Macroeconomic forces definitely influence an e-commerce brand's contribution margins but they can be effectively managed by good processes and decisions, which need the right technology. In our experience, you can use (the right) technology to forward forecast (i.e., predict) the possible range of environments you will face as a brand, and then make the (optimal) decisions that maximize your contribution margin across all those possible environments. To do this right, you have to deeply understand your unit economics, decision interactions, and the e-commerce platforms themselves. It is not an easy problem for humans because of the complexity but computers are excellent at understanding how to optimize a very complex decision space.

Retailers can be technology companies too

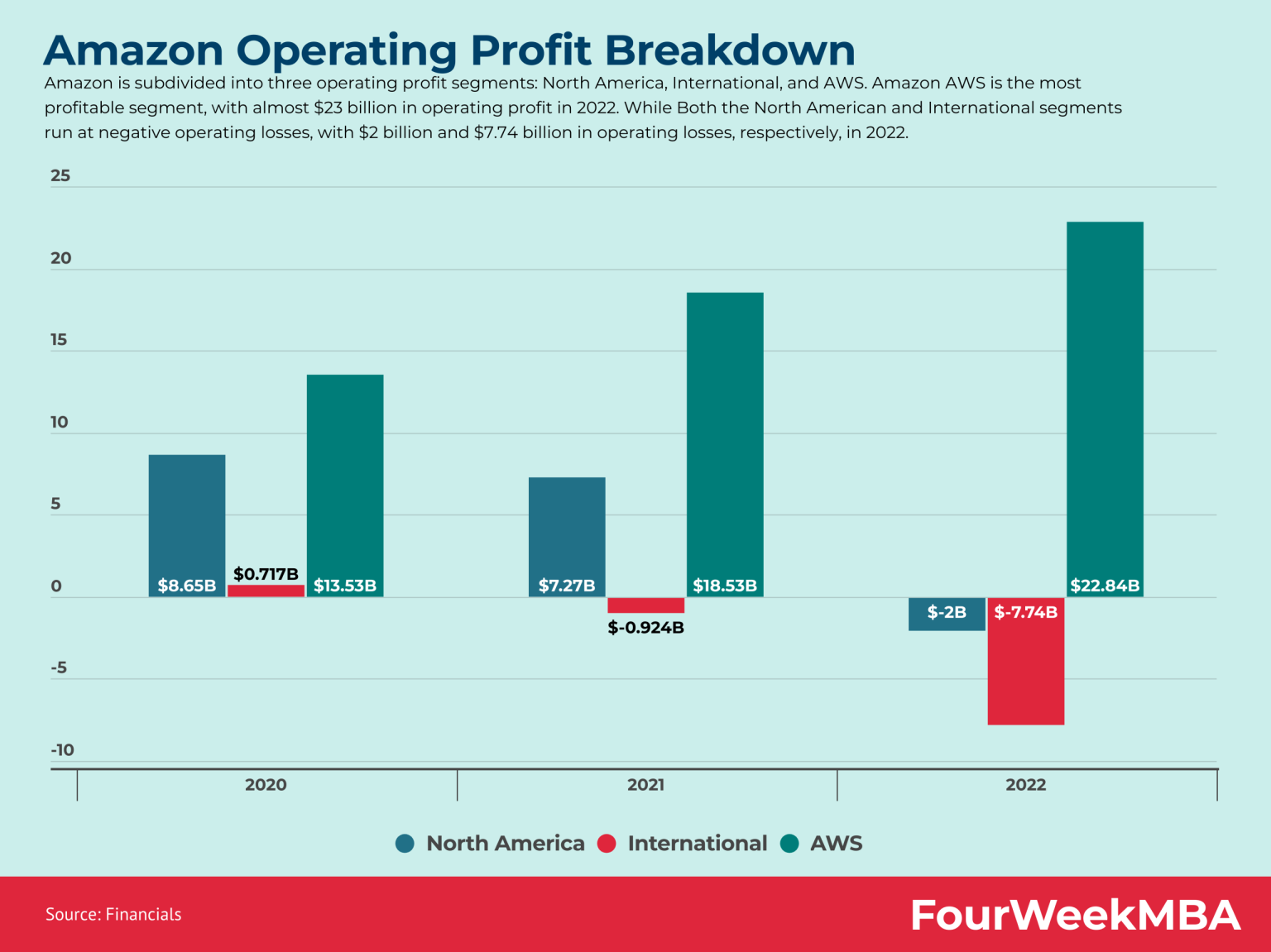

Let's be real. It is hard enough to be a retailer already that trying to also be a technology company seems foolhardy. Not even Amazon itself consistently makes money on their e-commerce business. Look at this chart from ForWeekMBA that shows in 2022 Amazon lost money on the .com business and only made profit thanks to AWS (75% of all Amazon profits are made by AWS since 2019).

Amazon is structured as a holding company with the .com retailer as one company and Amazon Web Services (AWS) as an entirely separate company with its own increasingly separate culture. If Amazon can't truly simultaneously be a retailer and a technology company, what chance do you have at achieving such a chimera?

Amazon is structured as a holding company with the .com retailer as one company and Amazon Web Services (AWS) as an entirely separate company with its own increasingly separate culture. If Amazon can't truly simultaneously be a retailer and a technology company, what chance do you have at achieving such a chimera?

My co-founder and I built technology within a retailer that owned 20+ brands. It was akin to Pickett's Charge in outcome. The primary reason was a difference in business focus and culture. What must be true to be an excellent retailer will make you a mediocre technology company; the reverse is true as well.

This difference, however, is an opportunity for brands everywhere because its possible to follow Amazon's lead: separate your retail business from its technology stack. Focus on being a "best of breed" retailer and leverage a dedicated technology company SaaS platform to operate your brands at scale and maximize contribution margin.

Training, Training, Training!

There is a chant going around in some multi-brand retailers that is channeling Steve Ballmer in all his glory. All you need as a brand is "training, training, and more training" to run your brand(s) into the Valhalla of maximized contribution margins. It is true that training is an absolutely necessary component of successfully building or operating an e-commerce brand. But as mathematicians love to say "it is a necessary but not sufficient condition" to achieve the outcome you need as a brand: maximum contribution margin with every sale.

Choice. The problem is choice. In the increasingly complex and costly environment that is e-commerce, training is not sufficient because the problem space is so complex humans can't understand all the decisions a brand must make, how those decisions interact with each other, and what set of decisions will optimize your brand's contribution margin. This is where the right technology can make the difference between a brand that dominates its space and a brand that dies less than 2-years after raising a $325M Series A.

Choice. The problem is choice. In the increasingly complex and costly environment that is e-commerce, training is not sufficient because the problem space is so complex humans can't understand all the decisions a brand must make, how those decisions interact with each other, and what set of decisions will optimize your brand's contribution margin. This is where the right technology can make the difference between a brand that dominates its space and a brand that dies less than 2-years after raising a $325M Series A.

So, what should I take away from Modern Retail's reporting?

The challenges that Modern Retail reported on are real. If you're a brand operator - small, medium or large - they will all be familiar to you. It doesn't matter if you run 1 brand or 100 brands. It's the explicit and implied solutions in the Modern Retail article that are problematic: they are too simple.

There, however, is a single (solution) thread running through all the challenges: technology. E-commerce brands need a sophisticated platform that enables better decision making to navigate their increasingly complex and costly world. symphonie is still in stealth but reach out if you want to learn more.