From $10B to (potential) bankruptcy... the rise and fall of the Amazon aggregation game

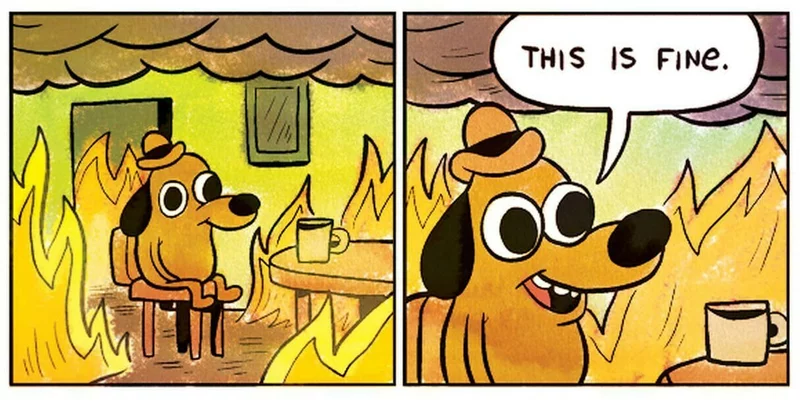

Yesterday CB Insights published a research brief on the rise and fall of Thrasio. From a $14M valuation in 2019 it grew to $10B in valuation by 2021. Wall Street liked what it saw and promptly bankrolled the creation of another 80+ aggregators. Our co-founders were the Chief Technology Officer (CTO) and Chief Supply Chain Officer (CSCO) of unybrands - 1 of the 80 - that raised $325M+ in capital. At the very moment the industry was hyper-expanding, it had already started to implode. By mid-2022 there were rumors that Thrasio was in trouble and today everyone is waiting for Thrasio to file for bankruptcy. Many of the aggregators founded in 2021 and 2022 are "dead men walking" shuffling aimlessly through the marketplace.

How did the industry crash so early in its birth? In late 2022 fresh from his departure as CTO of unybrands, our co-founder wrote a three-part series about the aggregator industry and its flaws:

- Flaws in the FBA Aggregation Business Model

- FBA Aggregation Model: How to Make a Problem Harder

- Cheap Replaceable Products Don't Make for a Happy Aggregator!

Ultimately what Wall Street got wrong is that what brands really need is not capital... its technology built by people who deeply understand technology and also know how to operate brands at scale. None of the aggregators will ever truly be or succeed as a technology company because their DNA is retail (and for many aggregators its not even retail... its Goldman Sachs).